EV Incentives & Ways to Save

There are lots of ways to save on the purchase or lease of your next EV. From your utility to tax rebate programs, click our menu items or scroll through to learn just how much you can save!

EV Tax Credit & Rebates

State & Federal

|

Get a credit of up to $4,000 for used vehicles purchased from a dealer for $25,000 or less! The amount equals 30% of purchased price, with a maximum credit of $4,000.

Note: Pre-owned vehicles purchased before 2023 don't qualify for this credit. However, new vehicles may qualify for other credits. Vehicle must be purchased from a dealer, have a sale price of $25,000 or less, and must have a model year two years prior to the current calendar year. Other requirements apply. |

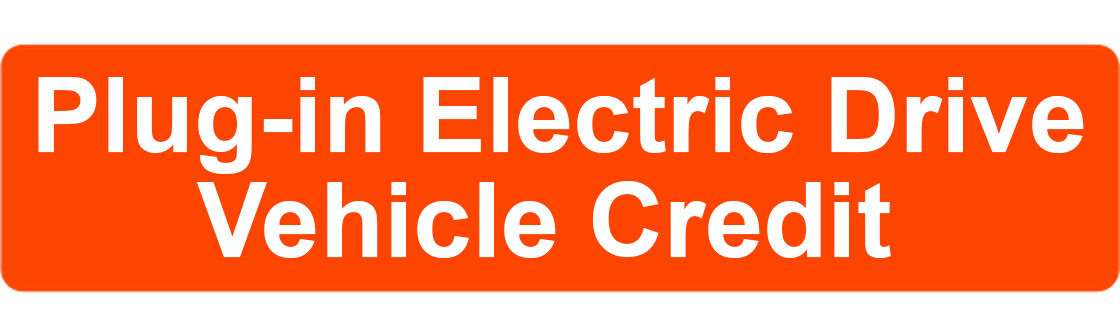

All-electric, plug-in hybrid, and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to $7,500.The availability of the credit will depend on several factors, including the vehicle's MSRP, its final assembly location, battery component and/or critical minerals sourcing, and your modified adjusted gross income (AGI). This tax credit an be combined with the New York State Drive Clean Rebate. Please refer to AFDC for more information and to claim credit, use Form 8936 Qualified Plug-in Electric Drive Motor Vehicle Credit.

|

The New York State Drive Clean Rebate is open to all car buyers in New York State. It is a point-of-sale rebate towards the purchase or lease of a new electric car. Rebate amounts of up to $2,000 are awarded based on the all-electric range of a vehicle. Can be combined with the Federal EV/PHEV Tax Credit.

|

|

The IRS gives eligible plug-in electric drive vehicles a tax credit up to $2500 and if it meets additional requirements, tax credit can be rewarded up to $7500. A list of qualified electric vehicles include passenger vehicles and light trucks: Qualified Plug-in Electric Drive Motor Vehicle Credit form.

|

The IRS gives eligible qualified fuel cell motor vehicles a tax credit up to $8000. Tax credits are also available for medium and heavy duty fuel cell vehicles. The Alternative Motor Vehicle Credit form has further instructions on how to claim for tax credit.

|

Check your if you are eligible for EV Tax Credit here

Our infographic below simplifies your eligibility requirements to help you understand which tax credits you may be eligible for.

Check your if you can save up to $9,500

Our infographic below simplifies your eligibility requirements to help you understand which tax credits/rebate you may be eligible for.

Utility EV Programs

Con Edison

|

Con Edison's PowerReady Program (formerly known as “Make-Ready”) provides incentives that will offset the electric infrastructure costs associated with installing chargers for electric vehicles. These incentives can lower infrastructure costs associated with preparing your site for electric vehicle chargers and receiving electric service from our grid. Learn more here.

|

If you own or lease an electric vehicle and charge it within the Con Edison service territory, SmartCharge New York pays drivers cash rewards to charge their EVs at off-peak times of day when demand for electricity is at its lowest. Charging off-peak helps reduce stress on the energy grid, making service more reliable for everyone. With SmartCharge New York, EV drivers can earn up to $1,000 annually! Click here to learn more and see how much you can earn.

|

Con Edison offers residential customers who drive plug-in electric vehicles (EVs) two time of use (TOU) rate options that reduce the price of electricity delivery during off-peak hours: a whole-house TOU rate with a one-year price guarantee and an EV-only TOU rate. EV owners on these TOU rates also receive a lower monthly customer charge if they annually provide Con Edison a copy of their EV registration. Learn more by visiting Con Edison’s electric vehicle website.

|

PSEG

|

When you use your qualified* smart charger between the hours of 11 p.m. and 6 a.m., you can earn $0.05 per kWh through the PSEG Long Island Smart Charge Rewards program. Visit the PSEG Long Island Smart Charge website for more information.

|

The EV Make Ready Program incentives the greater deployment of EV supply equipment (EVSE). May cover up to 100% of make-ready costs, including, utility-owned equipment and customer-owned equipment for charging infrastructure. Visit the PSEG Long Island EV Make Ready website for further information. Visit the PSEG Long Island EV Make Ready website for further information.

|

Central Hudson

|

Residential customers who own or lease a plug-in hybrid electric vehicle or an all-electric vehicle can get a time-of-use (TOU) rate from Central Hudson Gas & Electric.

Additional terms and restrictions that apply. Visit the Central Hudson Electric Vehicle TOU Rate website for more information, including how to enroll. |

O&R

|

Customers with eligible plug-in electric vehicles that participate in the Charge Smart Program and charge during off-peak hours can receive up to $450.

Residential users will pay a lower price for power used during the chosen off-peak hour under the voluntary TOU rate. Visit the O&R Electric Vehicle Rates and Charge Smart Program websites for more information, including how to enroll. |

National Grid

|

National Grid offers a discounted rate to residential customers for electricity used to charge PEVs during off-peak hours. Visit the Time of Use website for further information.

|

Electric Vehicle Perks

|

The Green Pass Discount Plan offers a special 10% discount to eligible Plug-In Electric and Plug-In Hybrid Electric vehicles. To be eligible, customers must first have an established E-ZPass account with NYSTA, and, proof of vehicle registration is required to receive the special 10% discount off of the E-ZPass rate.

|

The Clean Pass Program allows eligible plug-in EVs to use the Long Island Expressway HOV lanes, regardless of how many people are in the vehicle. Vehicles must display a Clean Pass vehicle sticker that is available from the New York State DMV.

|

In New York State, battery electric vehicles are exempt from state motor vehicle emissions inspections.

|

Discounts on Charging Infrastructure

State & Federal

|

Charge Ready NY 2.0 offers public and private organizations that install Level 2 EV charging stations at public parking facilities, workplaces, and multifamily apartment buildings rebates of $4,000 per charging port installed at a public facility (must be located within a DAC) and $2,000 per charging port installed at a workplace or multi-unit dwelling location. Visit the website to get started.

|

You or your business is entitled to a property credit for investments in new electric vehicle recharging property. The credit for each installation is equal to the lesser of $5,000 or 50% of the cost of property.

|

The Alternative Fuel Vehicle Refueling Property Credit from the IRS gives eligible US businesses and residents 30% off their entire EV charging hardware purchase (up to $30,000). Credit extends back to purchases made in 2018-2019.

|

Con Edison

|

Con Edison's PowerReady Program (formerly known as “Make-Ready”) provides incentives that will offset the electric infrastructure costs associated with installing chargers for electric vehicles. These incentives can lower infrastructure costs associated with preparing your site for electric vehicle chargers and receiving electric service from our grid. Learn more here.

|

A yearly per connector reward is available to owners of DC fast chargers that meet all of the following criteria: Minimum power capacity of 50 kilowatts (kW) in a single- or parallel-output configuration; A commonly accepted non-proprietary standard connector; Publicly accessible, without restriction or fees for parking. There are some additional terms and restrictions that apply. Visit the Con Edison Electric Vehicle Fast Charging Per-Plug Incentive website for more information, including annual incentive amounts.

|

For businesses in New York City and Westchester County that install a publicly accessible direct current (DC) fast charger, Con Edison offers a rate reduction ranging from 34% to 39%. The charger must have a power output of at least 100 kilowatts to be eligible.

There are some conditions that apply.The rate cut will be in effect until April 2025. Visit the Con Edison Business Incentive Rate page for more information, including how to apply. |

Central Hudson

|

Central Hudson Gas & Electric Level 2 and Direct Current (DC) Fast Charger Make Ready Program helps businesses and municipalities install and fund approved Level 2 and DC fast EVSE. Additional funding is available for projects in disadvantaged communities. There are other terms and restrictions that apply. Visit the Central Hudson Electric Vehicle Infrastructure Make-Ready Program website for more information, including the participation guide and application.

|

DC fast EVSE owners may be eligible for a yearly incentive per connector.

Owners of DC fast EVSE must meet the following requirements to be eligible: Each qualifying plug is capable of dispensing 50 kW or more; Use a commonly accepted non-proprietary standard connector; and be publicly accessible, without restriction or fees for parking. Payments are given on an annual basis from the date the equipment is installed until 2025. On a first-come, first-served basis, incentives are available. Additional terms and restrictions apply. Visit the Central Hudson DC Fast Charging Stations webpage for further information. |

O&R

|

Charger Ready makes installing Level 2 EV chargers at home more affordable for both residential and commercial Rockland Electric Company users by offsetting the expenses of EV charging infrastructure. Additional terms and conditions apply. Visit the O&R Charger Ready page for more information, including a participant guide and application.

|

National Grid

|

The Electric Vehicle Charging Station Program from National Grid provides non-residential clients Upstate New York customers with installation and funding assistance for certified Level 2 or direct current (DC) fast charger EVSE at businesses, multi-unit homes, and workplaces. Additional funding is available for projects that are located in disadvantaged communities. There are some additional terms and restrictions that apply. Visit the EV Charging Station Make-Ready Program for further information, including incentive qualifying levels.

|

National Grid offers an annual incentive for new, publicly accessible DC fast chargers (DCFC) for electric vehicles with a capacity more than 50 kW for installations between 2019 and 2025. Additional terms and restrictions apply. Visit the DCFC PerPlug Incentive Program for more information on incentive levels.

|

RG&E

|

The RG&E Level 2 and Direct Current (DC) Fast Charger Make Ready Program helps businesses and municipalities get eligible Level 2 or DC fast EVSEs installed and funded.

Additional funding is available for projects that are located in disadvantaged communities. There are some additional terms and restrictions that apply. Visit the RG&E EV Charger Make-Ready Program website for more information, including the participant guide and application. |

Owners of DC fast EVSE may receive an annual incentive per connector through 2025. To be eligible, owners of DC fast EVSE must: Ensure each qualifying plug is capable of dispensing 50 kW or more; Use a commonly accepted non-proprietary standard connector; and be publicly accessible, without restriction or fees for parking. Additional terms and conditions apply. For more information see the Rochester Gas and Electric (RG&E) DC Fast Charging Incentive Program website.

|

NYSEG

|

NYSEG EV Charger Make Ready Program helps businesses and municipalities get eligible Level 2 or DC fast EVSEs installed and funded. Additional funding is available for projects that are located in disadvantaged communities. Additional terms and restrictions apply. For more information, including the participant guide and application, see the NYSEG EV Charger Make-Ready Program website.

|

Owners of DC fast EVSE may receive an annual incentive per connector through 2025. To be eligible, owners of DC fast EVSE must: Ensure each qualifying plug is capable of dispensing 50 kW or more; Use a commonly accepted non-proprietary standard connector; and, Be publicly accessible, without restriction or fees for parking. Additional terms and conditions apply. For more information see the New York State Electric and Gas (NYSEG) DC Fast Charging Incentive Program website.

|

Funding for Fleets

State & Federal

|

Clean Agriculture is a voluntary program that promotes the reduction of diesel exhaust emissions from agricultural equipment and vehicles by encouraging proper operations and maintenance by farmers, ranchers, and agribusinesses, use of emissions-reducing technologies, and use of cleaner fuels. Visit DERA for more information.

|

The ZEV and Infrastructure Pilot Program provides funding to airports for up to 50% of the cost to acquire ZEVs and install or modify supporting infrastructure for acquired vehicles. Grant funding must be used for airport-owned, on-road vehicles used exclusively for airport purposes. For more information, see the Zero Emissions Airport Vehicle and Infrastructure Pilot Program website.

|

The Low or No Emission competitive program provides funding to state and local governmental authorities for the purchase or lease of zero-emission and low-emission transit buses as well as the acquisition, construction, and leasing of required supporting facilities. The Low or No Emission competitive program provides funding to state and local governmental authorities for the purchase or lease of zero-emission and low-emission transit buses as well as the acquisition, construction, and leasing of required supporting facilities.

|

|

Businesses and tax-exempt organizations that buy a qualified commercial clean vehicle may qualify for a clean vehicle tax credit of up to $40,000 under Internal Revenue Code (IRC) 45W. The credit equals the lesser of:

For more information, go to fueleconomy.org |

The Clean School Bus Program will provide funding to replace existing school buses with low- or zero-emission school buses. EPA can offer grants and rebates to assist fleets in purchasing new, cleaner school buses and the associated charging and fueling infrastructure.

|